By Engr. Adesegun Osibanjo

Part 1 – Electric Power

Energy conversations in Nigeria centre around Electricity (Electric Power) and Oil & Gas. Both are intertwined because On-Grid Power Plants and Off-Grid Diesel/PMS Electricity generation are both powered by Oil and gas. Power Plants run majorly on Gas and other sources like Hydropower while Generators run on Premium Motor Spirit (PMS), Diesel, and most recently LPG. Whatever happens in the Oil & Gas Sector has a direct proportionality impact on the Electricity sector and every other part of the Nigerian livelihood just as occasioned by the removal of subsidy on PMS and the spiking increase in the International price of Gas.

Charting the Roadmap to achieving self-sufficiency in Nigeria’s Energy sector in the face of the many daunting challenges impeding the rapid Economic development of the Country is very timely in addressing the challenges and offering recommended solutions.

This Treatise will however be addressed in two parts: Part 1 – Electric Power and Part 2 – Oil & Gas Energy.

The Evolution of Electricity in Nigeria

The clamour for Electricity (lighting) in Nigeria started in Lagos during the British colonial era in the late 1890 and early 1900. Colonization led to urbanization which came with vices such as burglary activities. Gas lanterns were utilized for lighting the streets of a certain part of Lagos Island to scare burglars at night. However, the lanterns were inadequate to serve the purpose for which they were required. In June 1891 further, calls were made on the Colonist by both educated Lagosians and the acting Governor George Denton to solve the defective lighting in Lagos. There was a proposed infrastructure Policy formulated by the Lagos Chamber of Commerce containing the maximum cost-effective means of implementation. The Lagos Lagoon water was suggested for the Generation of electricity in the correspondence between Lagos and London by the acting Governor. The important question then was the possibility of providing cost-efficient electricity of which Governor Carter also stated that the “question of efficiently lighting the town of Lagos has become one of great importance, and if it is financially practicable, I should like to see the electric system introduced.”

The question of affordability is as old as any invention made by man. The value of a commodity is dependent mainly on the target consumer’s ability to appreciate the effort, expenditure, and profit that would be charged as the price for the sale of a commodity. The first sustainability factor considered before the introduction of electricity in Nigeria is the ability of consumers to pay for the service.

Electricity generation

Electricity generation in Nigeria began in Lagos in 1886 with the use of generators to provide 60 kW. In 1950, the Legislative Council of Nigeria enacted a law establishing the Electricity Corporation of Nigeria (ECN) with the duties of developing and supplying electricity. ECN took over the electricity sector activities within the Public Works Department (PWD) and the Generating sets of Native Authorities. In 1951, the firm managed 46 MW of electricity.

Transmission Infrastructure Emergence

Between 1952 and 1960, the firm established Coal-powered turbines at Oji and Ijora, Lagos, and began making preliminary plans for a Transmission network to link the Power generating sites with other commercial centres. In 1961, ECN completed a 132 kV transmission line linking Lagos to Ibadan via Shagamu, in 1965, this line was extended to Oshogbo, Benin, and Ughelli to form the Western System.

In 1962, a statutory organization, the Niger Dams Authority (NDA) was formed to build and maintain dams along River Niger and Kaduna River, NDA went on to commission a 320 MW Hydropower plant at Kainji in 1969 with the power generated sold to ECN. In 1972 NDA and ECN merged to form the National Electric Power Authority (NEPA). NEPA was in charge of the Generation, Transmission, and Distribution of Electric Power in Nigeria. It operated as a vertically integrated utility company and had a total generation capacity of about 6, 200 MW from 2 Hydro and 4 Thermal power plants. This resulted in an unstable and unreliable electric power supply situation in the country with customers exposed to frequent power cuts and long periods of power outages and an industry characterized by a lack of maintenance of Power infrastructure, outdated Power plants, low revenues, high losses, power theft, and non-cost reflective tariffs.

Power Sector Reforms

In the year 2001, the reform of the electricity sector began with the promulgation of the National Electric Power Policy which had as its goal the establishment of an efficient electricity market in Nigeria. It had the overall objective of transferring the ownership and management of the infrastructure and assets of the electricity industry to the private sector with the consequent creation of all the necessary structures required to form and sustain an electricity market in Nigeria.

In 2005 the Electric Power Sector Reform (EPSR) Act was enacted and the Nigerian Electricity Regulatory Commission (NERC) was established as an independent regulatory body for the electricity industry in Nigeria. In addition, the Power Holding Company of Nigeria (PHCN) was formed as a transitional corporation that comprises 18 successor companies (6 generation companies, 11 distribution companies, and 1 transmission company) created by NEPA.

In 2O10, the Nigerian Bulk Electricity Trading Plc (NBET) was established as a credible off-taker of electric power generation companies. By November 2013, the privatisation of all generation and 10 distribution companies was completed with the Federal Government retaining the ownership of the Transmission company. The privatization of the 11th distribution company was completed in November 2014.

The Electricity Act (EA) 2023 was signed into law by President Bola Tinubu on the 8th of June 2023, repealing the 2005 Electric Power Sector Reform (EPSR) Act signed into Law by former President Olusegun Obasanjo. The Constitutional Amendment Act 2023 previously signed into Law on March 17, 2023, by former President Muhammadu Buhari paved the way for EA 2023 to be implemented with Constitutional backing.

The Electricity Act 2023 is the ultimate Game changer and Mother of all Electric Power sector reforms that will impact the desired massive improvements long desired in the Power sector, heralding the break of the Government’s monopoly and decentralization of Electricity supply meant to transform Nigeria’s Power sector into an efficient and competitive Industry by attracting significant private and foreign sector investments, promote the deployment of Nuclear, Renewables and other sources of Energy, create more access to electricity, and foster fair and transparent regulations that protect the interests of consumers. This will set the stage for the forces of Demand and Supply to determine the tide of the Electricity market in Nigeria and enable the Government to stop shoring up the Sector.

It is noteworthy to mention that the Federal Government has always shored up the Power sector from inception since 1886 which has impacted negatively on the sustainability of the entire Electricity Value chain: Generation, Transmission, and Distribution, which led to the Sector’s increasing business and financial non-viability and has made it very unattractive to Private and Foreign Investors.

Electricity Value Chain Challenges

The implementation of a hike in Electricity tariff was recently stepped down by President Bola Ahmed Adekunle Akanbi Tinubu GCFR in empathy with the Nigerian masses on the rising cost of living occasioned by PMS subsidy removal and insisting that subsidy be paid on Power consumed nationwide, as revealed by the Minister of Power, Adebayo Adelabu, at a Press briefing in Abuja. The Minister explained further that the President issued a directive that the Country must achieve regular and incremental Power supply before considering an increase in Electricity tariffs.

It is however critically essential to state that to attain the Presidential directive of achieving regular and incremental Power supply before considering an increase in Electricity tariffs and/or the implementation of the Electricity Act 2023 without first turning the Sector into a viable business and financial venture that will become attractive to Investors will only be a mirage. Establishing the Nigerian Electricity Supply Industry (NESI) market that is sustainable and encourages current and prospective Investors to inject the commitment and funding required to turn around the entire Electricity Value chain would require that the fundamental challenges that have crippled the Power sector since its inception be identified and wilfully addressed. The Challenges are listed below:

Liquidity Challenge

The 11 Electricity distribution companies (DisCos) in Nigeria’s electricity supply industry are losing as much as N4.79 out of every N10 worth of energy sold, data sourced from the latest Nigerian Electricity Regulatory Commission (NERC) has shown.

According to NERC, the development was due to a combination of inefficient distribution networks, energy theft, low revenue collection, and the unwillingness of customers, most particularly the unmetered consumers to pay their bills.

NERC says the 11 DisCos recorded Aggregate Technical, Commercial, and Collection (ATC&C) losses stood at 47.88% in the first quarter(Q1) of 2022. This is composed of 22.62% technical and commercial losses and 32.64% in collection losses.

In Nigeria’s power sector, ATC & C is a critical performance setting parameter in the Multi-Year Tariff Order (MYTO) that is used to determine the tariffs that DisCos are allowed to charge customers.

“Conversely, DisCos that underperform relative to their allowed ATC&C losses (i.e., a higher ATC&C loss than allowed), will be unable to earn the expected returns on its set tariffs and could risk long-term financial challenges,” NERC said.

Low revenue collection & Losses is the root cause of the critical and fundamental Liquidity challenge that has crippled the entire Electricity value chain of Generation, which led to the Sector’s increasing business and financial non-viability and becoming very unattractive to Private and Foreign Investors. This is the main reason compelling successive Governments to shore up the Sector to keep Lights on since inception. If DisCos can’t collect, The Nigerian Bulk Electricity Trading Plc (NBET) won’t be able to pay TCN and GenCos, as well as Gas suppliers.

Cost Reflective Tariff Regime Implementation Challenge

Cost-reflective electricity pricing requires DisCos to introduce tariffs that more strongly reflect their underlying costs. Good tariffs should be efficient, and equitable, provide stable bills for consumers and revenue for businesses, and be acceptable to customers. A Cost-reflective tariff reflects the true cost of supplying electricity and removes the reliance on Government subsidies to cover the variance between the current tariff and the true cost of supply of electricity. The inability to implement a Cost reflective Tariff Regime is the second most critical challenge that must be addressed to improve the Liquidity challenge of the Electricity sector to motivate current and prospective Investors to invest in the entire Value chain of the Sector.

Gas Supply Shortages

As earlier posited, Electricity distribution companies (DisCos) are finding it hard to collect significant revenue for energy distributed to customers. This also affects the Discos’ remittance to the Nigerian Bulk Electricity Trading Company (NBET) and market operators. Most of the DisCos do not offset up to 50 % of the market invoice for energy received.

NBET is the body that buys power from the GenCos through Power Purchase Agreements (PPAs) and sells to the DisCos through Vesting contracts. As a result of low remittances by the DisCos, NBET too has been unable to meet its obligations to GenCos. The ripple effect means GenCos too will be unable to pay Gas suppliers. A key operational and financial data of the industry indicates that between January 2019 to September 2020, NBET had a payment shortfall of N865 billion to GenCos.

In 2019, GenCos threatened to shut down power plants across the county if the Federal Government failed to intervene in the challenges troubling them. “GenCos indebtedness to their Gas suppliers is due to NBET’s indebtedness to them. No GenCo has any outstanding Gas payment that is more than what NBET is owing to GenCo. Put differently, NBET is indirectly charging 0.75% for paying its debt to GenCos” the Association of Power Generation Companies (APGC), the umbrella body for GenCos, said.

Stranded Power/Power Evacuation Challenges

Electricity supply remains a national problem, as over 40% of GenCos’ Power available capacity is not being enjoyed by consumers due to system constraints, the Generated power is rejected or forced to be reduced to match the infrastructure that transmits and distributes this power to the customer.

Stranded capacity has consistently grown since 2013 till date, thereby making GenCos increased capacity not translating to a corresponding increase in Power supply to consumers. It is an international industry best practice in critically underserved Countries, that available Generation capability should be equal to average Generation (energy utilized).

Citing World Bank 2021, as a result of these Power challenges, about 85 million people, representing 43% of Nigeria’s population are reportedly without access to Grid electricity, making Nigeria the country with the largest Energy access deficit in the world.

This has become a big challenge and an inhibitor to the Nigeria Electricity Supply Industry, (NESI) weakening the efforts of the Generation companies in recovering unavailable capacities and exploring expansion of capacity, considering the massive fixed charges incurred to keep such units available.

Recommendations

As clearly stated earlier on without ambiguities, the aforementioned Electricity Supply challenges MUST be sincerely and wilfully addressed by the Federal Government for any remarkable and positive improvements to happen in Electricity supply in Nigeria even with the enactment of the Electricity Act 2023.

The Quick win/fix strategies that must be implemented without delays include but are not limited to the following:

National Public Enlightenment & Stakeholders Engagement

There is an urgent need for a massive National public enlightenment and sensitization which must be extended to the Community levels to include Traditional and Religious Leaders to explain the under-listed in obvious, unambiguous, and understandable Ethnic languages as follows:

- that the Power sector is being repositioned for efficiency to attain the Presidential directive of achieving regular and incremental Power supply and to clearly explain the summary Implication of the commencement of the implementation of the Electricity Act 2023

- that the Electricity Act 2023 guarantees the de-centralization and de-monopolization of Nigeria’s Electricity generation, transmission, and distribution at the National level and authorizes States, Companies, and Individuals to generate, transmit, and distribute electricity. Under the Act, States are empowered to issue licenses to private investors who in turn would be permitted to set up and operate Mini-grids and Powerplants within the State

- that an efficient Power supply system will demand Payment cooperation for usage at current tariff regimes for sustainability from all Consumers

- that every Household/Apartment connected to an Electricity supply must be metered

National Mass Meter Deployment Project

Please recall that out of the AT&C losses of 47.88% in Q1 of 2022, Collection losses alone accounted for 32.64%. This figure is huge, scary, and insane for any Investor to take a plunge into any of the Electricity Value chains because Collection determines the Return on Investment (ROI) made on the business. Again, this is the real reason why successive Administrations have had to shore up the Sector to keep the Lights on in Nigeria.

The only way to achieve a permanent solution here is to Institutionalize the National Mass Meter Deployment Project wherein a Prepaid & Smart Electricity meter is installed in every Household/Apartment connected to the Electricity supply in Nigeria. This is to be supplied for free in principle but these investments can then be clawed back over some specified time via tax or other means as the Government deems appropriate to recover the cost of each Meter supplied. The Project will pay back itself with Profits. This will achieve the following:

- Eliminate debt and low revenue collection leading to the Liquidity challenge faced by DisCos or any prospective Electricity supplier

- Finally eliminate the ripple effect of the inability of DisCos to collect enough to pay the Nigerian Bulk Electricity Trading Plc (NBET), who in turn won’t be able to pay TCN and GenCos, as well as Gas suppliers

- Eliminate theft of Electricity and tampering with Electricity supply installations and conserve energy

- Restore both business & financial viability and Investor confidence in the Power sector

- Create a National/State Database for Electricity consumers that never existed since the inception of Electricity generation in Nigeria

The National Mass Metering Program of the Buhari Administration would have successfully achieved the solution for Collection losses if this was the approach adopted. In the words of Mr Ransome Owan, Managing Director, Aiteo Power and Gas Group, “The velocity of metered electricity or power to the consumers must be equal to the revenue coming back to the Operators. However, in our nation, there is an inequality sign which translates to revenue shortfall and this is one of the challenges we must address.”

Market Segmentation for Cost Reflective Tariff Implementation

It is strongly recommended that social stratification be applied to the Domestic consumers of the Nigerian Electricity Supply Industry (NESI) to further constitute into different market segments e.g. Highbrow and Lowbrow consumers.

The Highbrow consumers alongside the Industrial and Maximum demand (MD) consumers can then be classified into what may become known as the Stratified Band.

A Cost reflective tariff can then be easily implemented and applied to the Stratified Band consumers only, leaving out others for now on the condition and commitment that Electricity supply will be made regularly available to this Band. This will be gladly welcomed and not resisted by these Consumers because they are Elites and are well informed about the Cost-Benefit analysis (CBA) of regular on-grid Electricity supply against Electricity from the noisy and environmentally unfriendly off-grid Diesel/Petrol Generators.

This will also restore both business & financial viability and Investor confidence in the Power sector.

Match Investments in the Electricity Value Chain Infrastructure to Eliminate Stranded Power & Losses in the Value Chain

The inabilities of the GenCos to generate Electricity at the current total Installed capacity, that of the Transmission Grid infrastructure to fully evacuate and transmit the available Power generated by Power plants (though now being seriously contested by TCN due to claims of Infrastructure upgrade), and that of the Distribution infrastructure to evacuate and distribute Power from the Transmission Grid to consumers leading to unused Generated or Stranded power is also another critical challenge that must be fully addressed

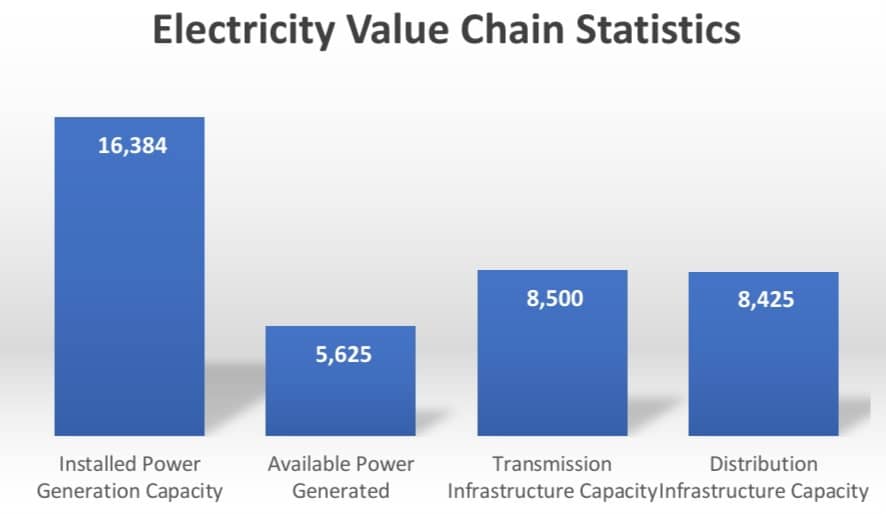

| Electrcity Value Chain Statistics | |

| Installed Power Generation Capacity | 16,384 |

| Available Power Generated | 5,625 |

| Transmission Infrastructure Capacity | 8,500 |

| Distribution Infrastructure Capacity | 8,425 |

The above Statistics as provided by TCN on behalf of the Honourable Minister of Power, reveal the Mismatch of the Electricity Value chain Infrastructure right from the Installed Power generation capacity of 16,384 MW, to available Power generated of 5,625 MW, to the Transmission infrastructure capacity of 8,500 MW, and up to Distribution infrastructure capacity of 8,425 MW are all asking for new Investments at the Federal level to be injected into new equipment & machines, upscale technology to World-class, develop human capital for maintenance, to deliver efficient and Customer-centric services and match up Infrastructures across the entire Electricity value chain to ensure that the installed Power generation capacity of GenCos are fully deliverable through the Transmission and Distribution infrastructures and supplied at very minimal losses to Consumers.

Conversion of Stranded Power to Direct Supply to Consumers

The 40% of GenCos’ available Power capacity that has been stranded and growing consistently since 2013 till date that is not translating to a corresponding increase in Power supply to consumers due to system constraints, which is rejected or forced to be reduced to match the infrastructure that transmits and distributes this power to the customer can now be sold by the GenCos directly to the Stratified band of consumers through the Embedded Generation or IPP Off-Grid Generation Sub-sector as contained in NERC guidelines.

This will also set the stage for GenCos to achieve the ambitious target of expanding Electricity generation capacity to about 30,000 megawatts (MW) by 2030.

Diversifying Nigeria’s Electricity mix

The Nigeria Energy Transition Plan launched in 2022 to chart the pathway for Nigeria’s ambitious plan of achieving Net zero (Carbon emissions) by 2060 with the strategy to move away from Fossil fuel sources such as Oil, Coal, and Gas (which is the primary feedstock of Power plants in Nigeria) towards renewables such as Biomass, Hydro, Geothermal, Wind, Solar, Nuclear (Uranium) and other energy sources coupled with the ever spiking astronomical increase in the International prices of Gas occasioned by the Russian-Ukrainian war and other Global crisis makes the diversification of Nigeria’s Electricity mix imperative.

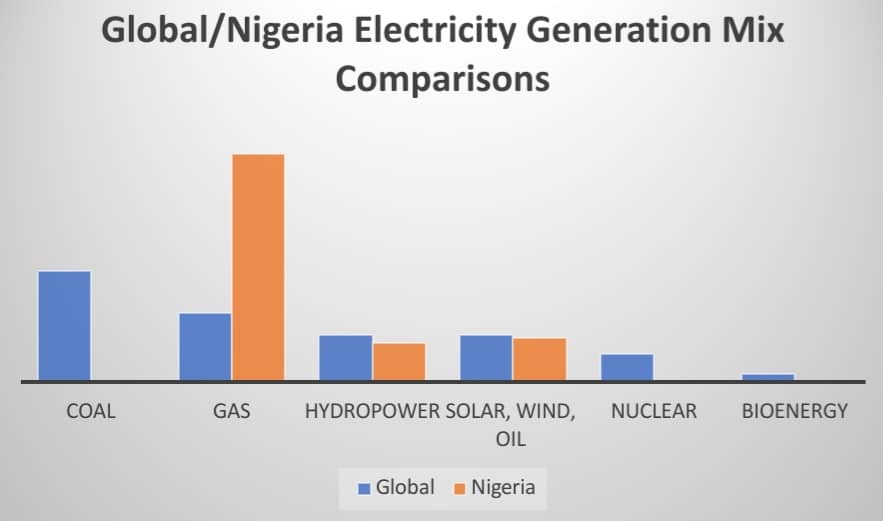

Now let’s take a brief Walk-through of the statistics of Global Electricity generation and of Nigeria’s Electricity generation mix and see how they compare.

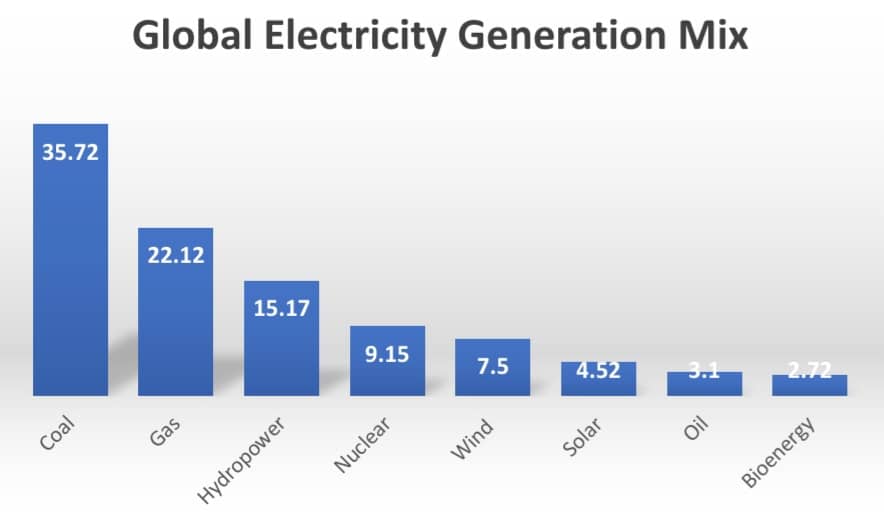

| Generation Source | MW (%) |

| Coal | 35.72 |

| Gas | 22.12 |

| Hydropower | 15.17 |

| Nuclear | 9.15 |

| Wind | 7.5 |

| Solar | 4.52 |

| Oil | 3.1 |

| Bioenergy | 2.72 |

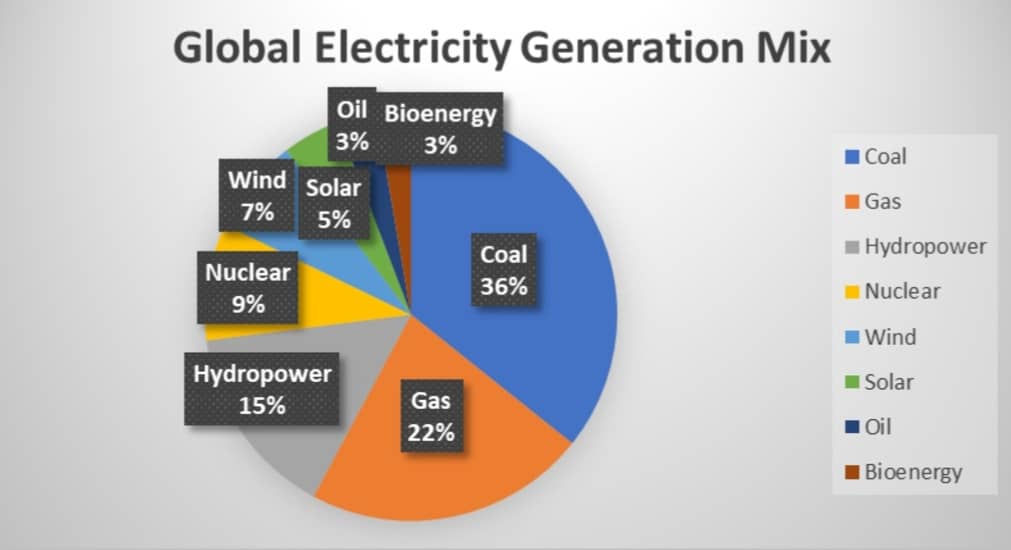

The above Statistics show Coal as the dominant Global source of Electricity generation with about 36% contribution, followed by Gas at 22%, Hydropower at 15%, Wind at 7.5%, and Solar at 5%. Nuclear at 9% and Bioenergy at 3%.

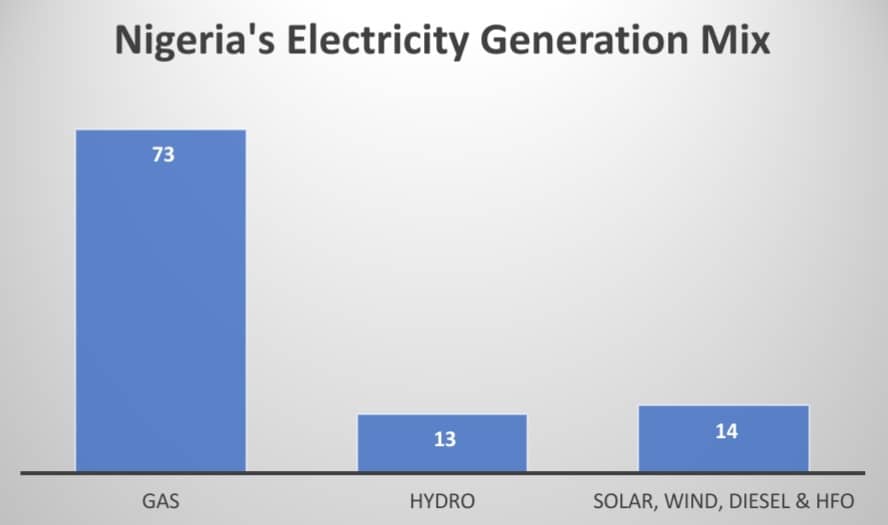

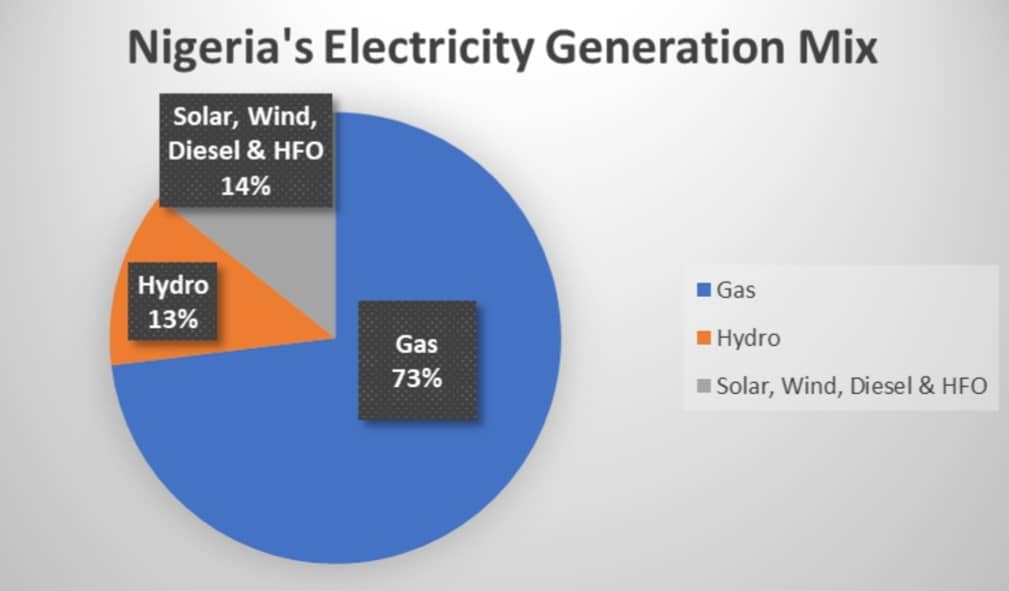

| Generation Source | MW (%) |

| Gas | 73 |

| Hydro | 13 |

| Solar, Wind, Diesel & HFO | 14 |

The Outlook for Nigeria as depicted above shows Gas at 73% as the dominant Electricity generation source, followed by Hydro at a distant 13%, while Solar, Wind, Diesel, and High Fuel Oil are grouped to make 14%.

The Global and Nigerian Electricity Generation mix statistics can only be compared based on Generation source in use and dominance, while the percentages will not be put into consideration because their analysis was achieved from different data sources and the figures cannot be compared on Apple for Apple basis.

Coal maintains the dominant lead globally while abandoned in Nigeria for now. Gas is the second most used source globally while it is the first most used, prevalent, and readily available source in Nigeria, Hydropower, Solar, Wind, and oil are all prevalent globally and in Nigeria at varying levels. Nuclear and Bioenergy are available globally while both are still at developmental stages in Nigeria. These comparisons lead to consideration for the following: Case for Coal review for Electricity generation, Research and development and Area of Concentration for Electricity Mix diversion and Caution on Renewable Energy.

The Case for Coal Review

As earlier posited, Coal dominates the Global Electricity generation mix at about 37% and interestingly makes 18% of America’s Electricity generation mix but since the Coal mines got shut down in Nigeria, we haven’t gone back to Coal exploration to solve our Energy needs. Clean Coal Technology (CCT) is the new deal in America and most parts of the world, but one wonders why we forgot about Enugu and Coal power. Enugu with its Colliery mines used to be the heartland of the Energy sector in Nigeria. The CCT program has also demonstrated a variety of new options for the control of sulphur oxides, nitrogen oxides, and particulate emissions from Electric Power plants operating on Coal. Furthermore, these new Power generation and pollution control options will permit Coal to continue to be used as fuel for Electricity generation while minimizing environmental impacts.

Case for Research & Development

The Nigeria Energy Transition Plan’s strategy to move away from Fossil fuel sources such as Oil, Coal, and Gas (which is the primary feedstock of Power plants Globally) towards some renewables may be highly counterproductive for Nigeria because it translates into abandoning naturally occurring, very reliable and sustainable Fossil fuels for some expensive renewables that may also not be sustainable.

It is also pertinent to state at this juncture that Nigeria is still struggling with inadequate Electricity generation capacity since inception, leading to frequent Power outages and limited access to Electricity for over 200 million people and our Electricity Generation mix currently relies heavily on Gas for which Nigeria is very well endowed with and holds the largest natural gas reserves in Africa, and the 9th largest globally, with an estimate of 200.79 trillion cubic feet (Tcf) that can power the whole of Africa and beyond.

Rather than move away from Fossil fuel sources, Nigeria should rather take a cue from the American experience on Coal adaptation to produce low carbon emissions on Electricity generation by launching research and development initiatives into Fossil fuel adaptation to produce low carbon emissions on Electricity generation.

Please be reminded again, that the first sustainability factor considered before the introduction of electricity in Nigeria is the ability of consumers to pay for the service. Moving Electricity generation sources away from Fossil fuels to some renewables may deny Electricity access to ordinary Nigerians who may not be able to afford the cost.

Area of Concentration for Electricity Mix Diversification

Nigeria’s Nuclear energy capacity and Uranium exploration is suggested for greater Government focus and attention in solving Nigeria’s Electricity challenges and advancing Nigeria’s ambitious plan of achieving Net zero (Carbon emissions) by 2060.

The Federal Ministry of Power needs to collaborate with the Federal Ministry of Solid Minerals and other relevant Agencies to drill further into the commercial development of Uranium for Nuclear Power generation.

Nigeria has no Nuclear Power Plants (Nuclear Reactor) to date, but keeps committing to building Africa’s second and third Nuclear Power Plants after South Africa, the only Country on the continent with a commercial Nuclear Power Plant. Nigeria built relationships with Russia and the Russian State Nuclear Corporation Rosatom in a strong bid to actualize the commitment with no visible progress recorded so far. The Russian-Nigerian Joint Coordination Committee (JCC) on National Atomic Energy was first established in 2009 with the goal of having completed Nuclear Energy plants by 2020. This has not worked out for “undisclosed reasons”. Additionally, there is the worry of and a “need in particular to avoid weapons proliferation” (Bolodeoku).

The Agreement for two Power plants: the Geregu Nuclear power plant (central Nigeria) and the Itu Nuclear power plant (southern Nigeria) still subsists. Both Power plants are expected to be Twin reactors that will each cost around $10 billion. As expected, Russia will be paying for the majority of the project.

There is a critical need for the Honourable Minister of Power, Chief Adebayo Adelabu to revisit, reactivate the Agreement and also validate the first sustainability factor considered before the introduction of Electricity in Nigeria, which is the ability of Consumers to pay for Nuclear Power generation.

Caution on Renewable Energy

The M.D & Group CEO of NNPCL, Mele Kyari, represented by the Executive Vice President (EVP), Upstream NNPCL, Oritsemeyiwa Eyesan, while speaking at the 41st Nigerian Association of Petroleum Explorationists’ (NAPE) International Conference and Exhibition, cautioned that the cost of Renewable energy is not budget friendly and could delay efforts by Nigeria and other African countries with limited economic resources from making progress. He also observed that a huge energy space that is clean but not affordable cannot be sustainable considering Nigeria’s Energy poverty.

The 10 MW Kano Solar Power Plant is a perfect example of a Renewable energy project that is not budget-friendly, it took 2 years to complete and came online in January 2023 and is the only known Large-scale Solar Power Plant in Nigeria that is jointly owned by the Federal Government of Nigeria, the Kano State Government and the host Local Government Area, Kumbotso. This Plant, however, is without the Private sector participation. This Project is not sustainable and may not survive beyond three (3) years give or take. If we drill further, don’t get alarmed that the Solar Power Plant may be supplying Electricity to Kano and the targeted environs for free. Please note also that Solar Power storage batteries and other accessories are very expensive, the Batteries get drained super-fast when supplying heavy loads, and the Lifespan gets shortened necessitating earlier replacements of the Batteries which adds to the cost of installation. The truth about it is that Solar power is not Budget-friendly for the masses and not durable and reliable for heavy loads. Load limiting devices are strongly suggested to be installed in Houses powered by Solar Power Plants to protect the storage Batteries against Electric power drains that are life span shortening to manage maintenance costs efficiently.

The only known tested, trusted and reliable form of Renewable energy remains Hydropower whose reliability is currently under threat by the Coup in the Sahel region of West Africa, particularly Niger which is facing severe sanctions from the ECOWAS’ demand for the restoration of the Country’s deposed civilian President Mohamed Bazoum. Any of the Countries Niger, Republic of Benin, and Togo may wake up one day and commence the damming of River Niger within their boundaries and this may ultimately cutoff Hydropower to Nigeria and render all Hydropower Generating Stations in Nigeria redundant and become wasted monumental Investments.

Fixing the Gas Challenge

Nigeria holds the largest natural gas reserves in Africa, and the 9th largest globally, with an estimated 200.79 trillion cubic feet (Tcf), yet only a little is tapped. The reserve is estimated to rise to 210.8 Tcf by 2022. Unarguably, Nigeria’s oil and gas sector is the mainstay of the Country’s economy.

Again, Liquidity is the cause of the non-availability of Gas for Power generation. The Federal Government has to sustain the Power Assurance Guarantee (PAG), like the N701 billion released in 2017 for NBET to guarantee payment for the evacuation of electricity produced by the GenCos, so that they can pay Gas suppliers. With the expiration of the payment assurance scheme, GenCos had raised the alarm over a N1.7 trillion shortfall.

The PAG has to be sustained until the Liquidity challenge which has rendered the Electricity value chain financially unviable is resolved through the National Mass Meter Deployment Project to facilitate the full implementation of the Electricity Act, 2023, hopefully believing that the Administration of President Bola Ahmed Tinubu will buy-in to the Project.

Extension of Gas Pipeline to Geo-Political Zones

Nigeria’s 614-km (384-mile) AKK Natural Gas pipeline corridor should be extended to run across the entire Six (6) Geo-Political zones to facilitate the siting of Gas Power Plants across the Country to assist further in monetizing our abundant Gas resources which are listed as one of the largest natural Gas reserves in the world and bring Electricity supply closer to the masses.

It should be noted also that Associated Petroleum Gas-APG also known as Flare Gas is a common practice in the Oil and Gas Industry, long associated with wasted energy and environmental concerns. However, innovative solutions are emerging to turn this harmful practice into an opportunity for Power generation. Gas turbines, renowned for their efficiency and flexibility, are leading the change in utilizing Gas flare as a free and sustainable fuel source.

Data from the National Oil Spill Detection and Response Agency showed that from January to November 2022, Nigeria flared an estimated 5.6 billion standard cubic metres of Gas valued at $685m which is 11% of the Nation’s daily Gas production of about 1.2 billion standard cubic feet (SCUF) with 41% exported, and 48% goes to the Domestic market.

Channel Flare Gas as Feedstock for New Power Generation Plants

The waste Flare Gas of 11% of the Nation’s daily Gas production valued at $685m should be channeled as feedstock to as many Gas Power plants as possible to be situated close to the source.

Despite many commitments to take action, the race to zero routine Flaring by 2030 in Nigeria is undermined by inconsistent Policies, weak implementation and an apparent lack of Political will by successive Administrations. Between 1969 and 2020, 10 deadlines to end Gas flaring in the Niger Delta were changed.

Electricity Export

Interestingly, while Nigerians are yet to enjoy stable and reliable Electricity, the Country currently exports Electric Power to some neighbouring Countries, especially the Republics of Benin, Niger, and Togo.

Expectedly, this development has engendered criticism, especially as these Countries don’t pay promptly for the Electricity supplied. Consequently, stakeholders and many Nigerians are wondering why the Government has continued to engage in this unfruitful venture when the country’s Power sector is facing a serious liquidity crisis.

It should be noted that Nigeria’s supply of electricity to these countries is more of an International Bilateral agreement which became a Multilateral Energy Sales Agreement than a business consideration. At the heart of the Agreement is the Damming of the River Niger. Nigeria dammed River Niger, it is strategic that we provide electricity to the Countries (Benin, Niger, and Togo) that are upstream on the River to encourage them not to build their Dams to avoid cutting off Hydropower feedstock to our Hydro Power Plants and further plunge our Electricity generation into crisis.

Mr. Nnaemeka Ewelukwa, Managing director, NBET revealed that only 6% of the electricity generated in the country is sold to neighbouring countries.

However, the Privatization of the Power sector in Nigeria in 2013 changed the narrative of the Multilateral Energy Sales Agreement to a new business model, known as, the “Willing Buyer, Willing Seller” which is now deployed in serving the Niger, Benin, and Togo to ease the Liquidity challenge of the sector.

The Honourable Minister of Power, Chief Adebayo Adelabu may need to confirm from the Managing Director of TCN, Sule Abdulaziz, who is also the Chairman, of the Executive Board of West African Power Pool (WAPP), and by extension use, this position to encourage the Nigerian Power operators (GenCos) to gear up to take part in Electricity export as soon as the Regional Electricity Market (REM) of the West African Power Pool (WAPP) is launched, has the authorization of the Nigerian Government to extend the Multilateral Energy Sales Agreement to other Countries in West Africa apart from Niger, Benin, and Togo.

While acknowledging Nigeria’s enormous potential in Electricity generation, It is, however, logical that we achieve a stable, reliable, affordable, and self-sufficient Electric Power supply at Home before launching into full-blown Electricity export. Yes, foreign exchange revenue earning is highly desirable in the present situation of the Country but we need to be better focused and not lose one of the Government’s top priorities to deliver the dividend of democracy to the loyal and understanding Citizenry.

Conclusion

MaakBeat Transnational Ltd is available and ready to collaborate with the Federal and State Governments willing to implement the recommendations of this Roadmap to achieve Self-sufficiency in the entire Electric Power Value chain as Consultants, starting with both the National Public Enlightenment & stakeholder engagement and the National Mass Meter Deployment Project to achieve Payment collection to solve the primary and fundamental challenge of Liquidity to make the Sector both business and financially viable to attract foreign and private Investors before proceeding with the implementation of the other recommendations.

This is also boldly telling and encouraging Off-Grid Diesel/PMS Electricity Generator Importers, Sales, and service merchants to jump Ship and come invest in any or all of the Electricity Value-chains to take advantage of the vast opportunities therein to make humongous profits and return on Investments (ROI) and you will never regret taking such decisions. Again, MaakBeat Transnational Ltd will guide you professionally to achieving full-blown success.

Acknowledgment

This Article is a follow-up on, Towards Achieving Uninterrupted Power Supply in Nigeria written by Sir, Engr, Chief Abayomi Awodipe FNSE, a father and very senior Professional colleague. He fully inspired this write-up to the glory of God Almighty.

About the Author

Evangelist, Engr. Adesegun Olutayo Osibanjo attended the prestigious Ahmadu Bello University Zaria, Nigeria, where he obtained a Bachelor of Engineering (B.Eng.) degree in Electrical Engineering and also obtained a Master in Business Administration (M.B.A) degree in Marketing Management option from the Lagos State University Ojo, Lagos, Nigeria.

Engr. Osibanjo works for MaakBeat Transnational Ltd, an Energy, Engineering, Project & Construction Consulting, Procurement/Logistics, Safety, and Agricultural Value chain Company. He is a COREN registered Engineer, a Member of the Nigerian Society of Engineers (NSE) and Chartered Institute of Purchasing & Supply Management of Nigeria (CIPSMN), and has attended many Courses locally and internationally.

Evangelist Osibanjo is the Organizing Secretary of the Directorate of Politics & Governance of the Redemption City of God Chapter, and General Secretary of the Board of Trustees of God’s Kingdom Gospel Church, an International Ministry with presence in the United Kingdom and South Africa.

He is also a Political Evangelism Crusader engaging and encouraging the top echelon of Faith based Institutions like the Christian Association of Nigeria (CAN) to add the role of Political Torch-bearers as part of their responsibilities to their congregations and followers to become actively involved in Grassroots Politics. He is a renowned National and Global Affairs Analyst and Commentator.

Author’s contacts

Email: adeolu.osibanjo@outlook.com, maakbeat@gmail.com, ceo@maakbeat.com

X (formerly Twitter): @BoboOshy

References:

Towards Achieving Uninterrupted Power Supply in Nigeria – Sir, Engr, Chief Abayomi Awodipe (FNSE)

Nigeria: The Electricity Act 2023 And the Constitutional Amendment Act 2023: Implications for The Power Sector – Gabriel Onojason , Ngozi Chinwa Ole and Lynda UgochinyereEzike (Alliance Law Firm)

NERC Website

Transmission Company of Nigeria (TCN)

2 comments

[…] Read also: Roadmap to achieving self-sufficiency in Nigeria’s energy sector Part 1: https://churchtimesnigeria.net/roadmap-to-achieving-self-sufficiency-in-nigerias-energy-sector/ […]

[…] in Nigeria’s Energy Sector: Part 1 – Electric Power – Published by Church Times Nigeria: https://churchtimesnigeria.net/roadmap-to-achieving-self-sufficiency-in-nigerias-energy-sector/ and Roadmap to Achieving Self-Sufficiency in Nigeria’s Energy Sector: Part 2 – Oil & Gas […]